SC DoR ABL-920 2022-2024 free printable template

Show details

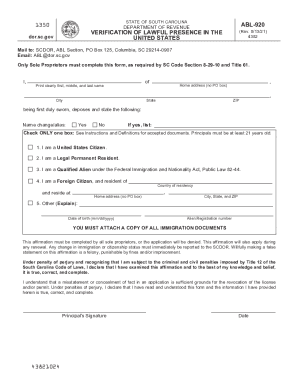

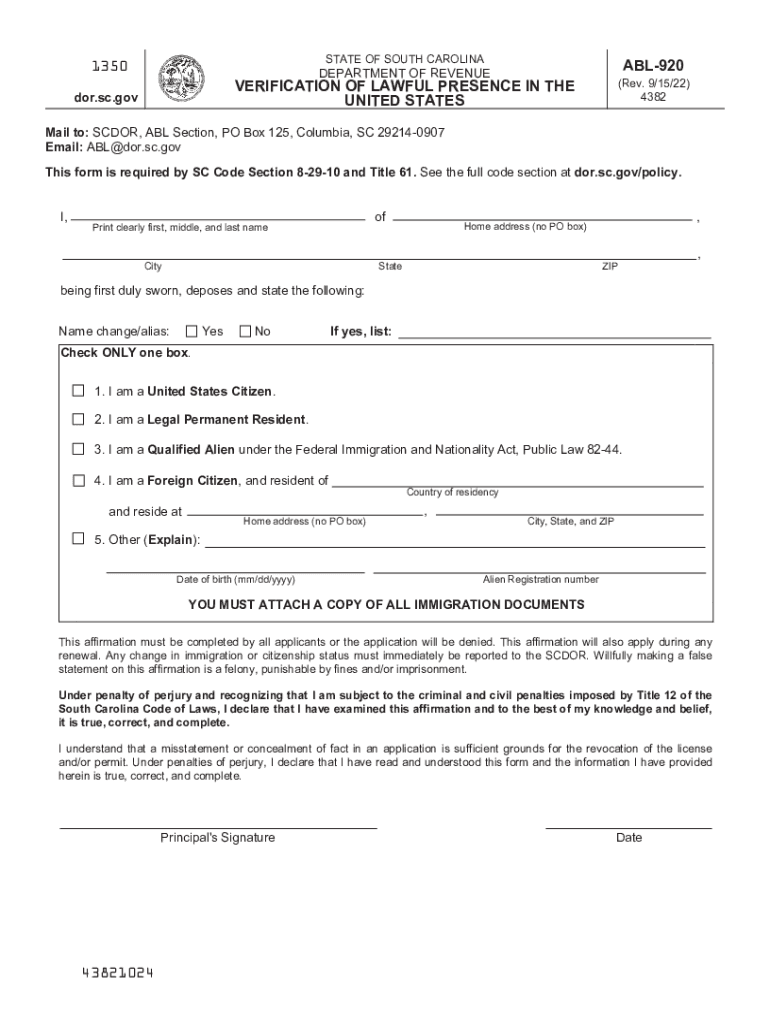

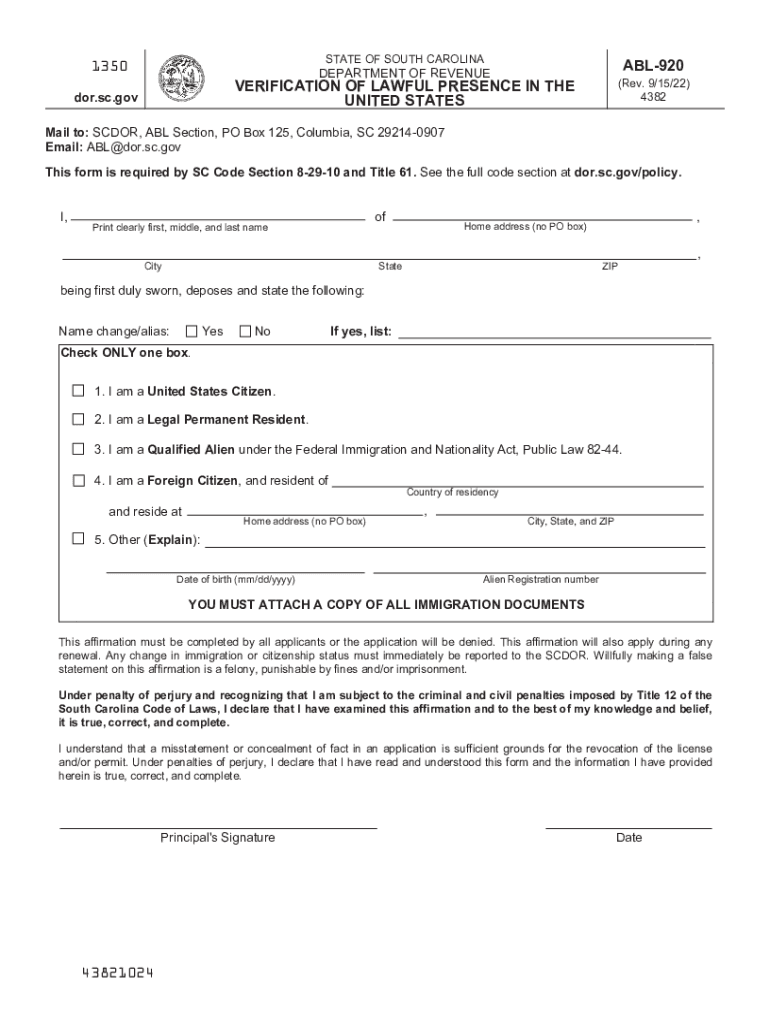

STATE OF SOUTH CAROLINA1350ABL920DEPARTMENT OF REVENUE(Rev. 9/15/22)

4382VERIFICATION OF LAWFUL PRESENCE IN THE

UNITED States.SC. Gmail to: SCOR, ABL Section, PO Box 125, Columbia, SC 292140907

Email:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your carolina states 2022-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your carolina states 2022-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit carolina states online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit abl 920 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

SC DoR ABL-920 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out carolina states 2022-2024 form

How to Fill Out Carolina States:

01

Gather all required information such as personal details, contact information, and relevant identification documents.

02

Access the official website of Carolina States or visit their physical location to obtain the necessary forms.

03

Carefully read through the instructions provided on the forms and ensure you understand all the requirements.

04

Fill in the forms accurately and legibly, providing all the requested information.

05

Double-check your entries to avoid any mistakes or omissions.

06

Attach any necessary supporting documents as indicated on the forms.

07

Review the completed forms one last time to ensure everything is accurately filled out.

08

Submit the filled-out forms along with any required fees either online or by mailing them to the designated address.

09

Keep copies of all the submitted forms and any supporting documents for your records.

Who Needs Carolina States:

01

Individuals who reside in Carolina and require a state identification card or driver's license.

02

People who have recently moved to Carolina and need to update their identification records.

03

Anyone who wants to access various services or benefits that require Carolina state identification, such as opening a bank account or applying for government assistance programs.

Video instructions and help with filling out and completing carolina states

Instructions and Help about abl920 form

Fill sc voter : Try Risk Free

People Also Ask about carolina states

Can I become a U.S. citizen after 3 years?

Can you get U.S. citizenship in 2 years?

How long after green card do you get citizenship?

Can I apply for U.S. citizenship after 2 years?

What is the minimum years to become a U.S. citizen?

Can I apply for citizenship after 3 years of PR?

How long do you have to stay in U.S. to become a citizen?

Can I apply for U.S. citizenship after 3 years of green card?

Can I apply for citizenship after 2.5 years?

What is the 6 month rule for citizenship?

What is the 5 year rule for U.S. citizenship?

How many years you need to stay in U.S. for citizenship?

What is the green card 3 year rule?

What is the 3 year rule for citizenship?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is carolina states?

There is no known entity called "Carolina States." It is possible that you may be referring to North Carolina State University, which is a public research university located in Raleigh, North Carolina. Is that what you were referring to?

Who is required to file carolina states?

The term "Carolina states" is not clear. If you are referring to South Carolina and North Carolina, the individuals or entities required to file state taxes in these states may include:

1. Residents of South Carolina and North Carolina who have income that meets the state's filing thresholds.

2. Non-residents or part-year residents who earned income within South Carolina or North Carolina that exceeds the state's filing requirements.

3. Businesses, including corporations, partnerships, LLCs, or sole proprietorships, that operate within South Carolina or North Carolina and have income or nexus within the state.

4. Individuals or entities that own real estate or property in South Carolina or North Carolina may also have specific tax requirements.

It's important to note that tax laws and filing requirements may vary, so it is recommended to consult the specific guidelines provided by the South Carolina Department of Revenue and the North Carolina Department of Revenue or seek professional tax advice.

How to fill out carolina states?

To fill out a Carolina state, such as North Carolina or South Carolina, you can follow these steps:

1. Obtain the necessary forms: Visit the official website of the specific state's Department of Revenue or Taxation to download the appropriate forms for filing taxes. Usually, these forms are available in a printable PDF format.

2. Gather your documents: Collect all the necessary documents required for filing your taxes, such as W-2 forms, 1099 forms, receipts for deductible expenses, and any other income-related documents.

3. Complete personal information: Fill out your personal information at the top of the tax form, including your name, address, Social Security number, and other relevant details. Ensure that the information provided is accurate.

4. Report income: Review your income-related documents and accurately report your income on the tax form. This may include wages, salaries, tips, interest, dividends, rental income, and any other sources of income.

5. Deductions and credits: Determine if you qualify for any deductions or credits that can help reduce your overall taxable income. Common deductions include mortgage interest, property taxes, medical expenses, and student loan interest. Credits can include child tax credit, education credits, or energy-efficiency credits, among others.

6. Calculate taxes owed: Using the provided tax tables or tax calculation sheets, determine the amount of tax you owe based on your income and deductions. If you use tax preparation software or platforms, they will automatically calculate this amount for you.

7. Review and sign: Carefully review all the information entered on the tax form to ensure accuracy. Cross-check numbers, verify calculations, and make any necessary corrections. Once reviewed, sign and date the form to certify the accuracy of the information provided.

8. Submit the form: Make a copy of the completed tax form for your records and attach any required supporting documents. If filing electronically, follow the instructions provided on the official website to submit your tax return electronically. If filing a paper return, mail it to the designated address mentioned on the form.

Note: The exact process may vary slightly depending on the specific Carolina state you are filing taxes for. It is always advisable to consult the official website or seek assistance from a tax professional for accurate and up-to-date information.

What information must be reported on carolina states?

To provide information on "Carolina states," the question needs to be clarified. It could be referring to states within the Carolinas (North Carolina and South Carolina), or it could be referring to something specific to Carolina states that is not clear. Please provide more details or rephrase the question for a more specific response.

What is the penalty for the late filing of carolina states?

The penalty for late filing of Carolina state taxes varies depending on the specific circumstances and tax laws in the state. Generally, a penalty is assessed for late filing and/or late payment of taxes. These penalties can be a percentage of the taxes owed or a flat rate. It is recommended to consult the North Carolina Department of Revenue or a tax professional for the most accurate and up-to-date information regarding penalties for late filing of Carolina state taxes.

How can I manage my carolina states directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your abl 920 form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make changes in sc form verification lawful presence?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your state carolina south to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit lawful presence form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share sc lawful presence form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your carolina states 2022-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Form Verification Lawful Presence is not the form you're looking for?Search for another form here.

Keywords relevant to south carolina verification lawful form

Related to south carolina verification presence

If you believe that this page should be taken down, please follow our DMCA take down process

here

.